Out-Law / Your Daily Need-To-Know

Out-Law Analysis 8 min. read

UK's mid-market deal terms shaped by Covid-era and market competition

21 Jun 2021, 3:24 pm

The way payments were structured and risk protection operated in deals in the UK's mid-market and private equity M&A markets changed in 2020 as buyers sought greater protection in uncertain times.

Pinsent Masons, the law firm behind Out-Law, Arrowpoint Advisory and Howden M&A have analysed the structures of 183 deals done in 2020 to uncover shifts in the mechanics of how those deals are conducted.

Coronavirus lockdowns have created well-documented business uncertainty, but demand for quality assets has remained high and as a consequence seller price expectations have in many cases remained at least at pre-pandemic levels.

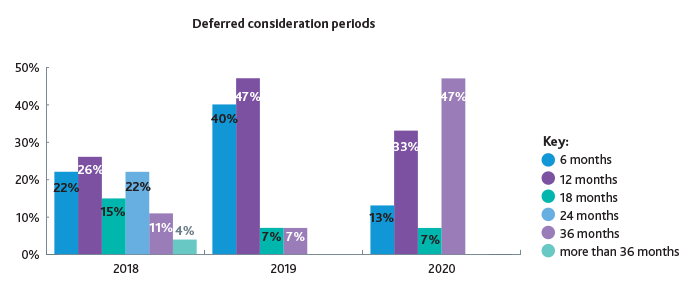

The 2020 deals surveyed by us indicate a growing use of deferred consideration structures as they provided a means of bridging valuation gaps caused by concerns around either the sustainability or recovery of earnings. As we emerge from the pandemic and trading patterns return back to normal, it will be very interesting to see whether deferred consideration or earn out consideration structures remain so prevalent or not.

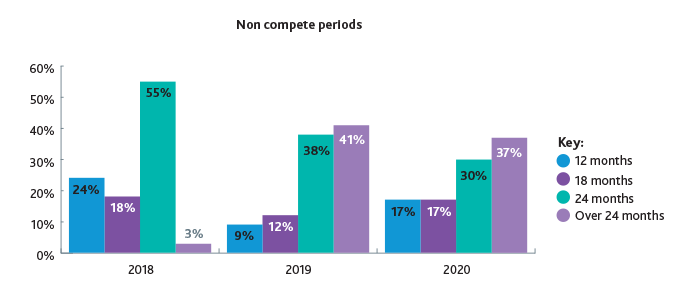

Evidence that we still continue to operate in a seller's market is perhaps also provided by our survey results in respect of restrictive covenants, by which a buyer restricts the competing activities of sellers after they have left the company. Their duration in these deals shortened last year, a trend which may need to be considered in parallel with the revisions to consideration structures. It could mean that there is a growing acceptance that there has to be a significant carrot as well as stick to assure the long term success of the business and support from its founders/sellers.

Evidence that we still continue to operate in a seller's market is perhaps also provided by our survey results in respect of restrictive covenants, by which a buyer restricts the competing activities of sellers after they have left the company. Their duration in these deals shortened last year, a trend which may need to be considered in parallel with the revisions to consideration structures. It could mean that there is a growing acceptance that there has to be a significant carrot as well as stick to assure the long term success of the business and support from its founders/sellers.

Arrowpoint Advisory managing director Simon Cope-Thompson also told us: "Management terms are certainly being squeezed; private equity are cautious about packages that they think may have become over-generous in recent years. Management teams are therefore having to work harder to get the same deals as could be readily secured two years ago."

"Sellers are less likely than before to have a large number of buyers lined up as private equity houses are being more selective about which deals they run hard at and are being more proactive about originating deals," he said. "With lots of funding out there they need to know what their angle on a deal is. Firms have institutional memories about what has worked for them in the past and that guides what they go for."

There have been interesting moves in relation to sweet equity, a share of the post-buyout company given to management teams by private equity funders to incentivise high performance. There has been a reduction in the most generous and least generous allocations over the past three years, and an increase in the number of deals offering a mid-range share of 10-20%.

There is however evidence of investors exercising more control over equity. Leaver provisions which strip leavers of equity if they leave in acrimonious circumstances were applied increasingly to rollover equity, up from 39% of deals to 65% between 2019 and 2020. So while investors may be being more generous in many cases, it comes with some element of increased control.

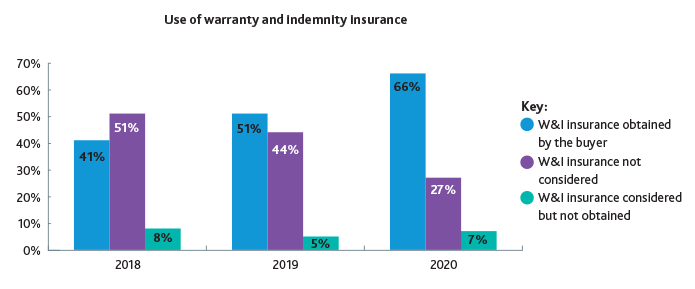

While certain private equity houses have been resistant to using W&I insurance on the basis that they have done deals for years without it, this approach is becoming less sustainable in the current market conditions. Given the amount of ‘dry powder’ available, compared to the relatively limited number of good quality investment opportunities, it is now more important than ever for investors to make their bids as attractive as possible. If all of the competing bidders in an auction process are using W&I insurance, and thereby offering to cap the warrantors’ liability at a nominal amount, not using insurance can become a significant disadvantage.

Having insurance streamlines transaction negotiations. Without insurance, the warranties and indemnities will be negotiated in granular detail: sellers will want them drafted narrowly, while buyers push for as broad a suite of warranties as possible. W&I insurance eases the tension in these negotiations and makes the deal a little easier to get over the line.

Historically, insurance was not used on lower cap deals or investments. However, with more insurers focusing on this end of the market, minimum premiums are coming down and take-up is on the rise.

Broadly speaking, as insurers chased fewer deals between March and September of last year, we saw average pricing and deductibles drop again in 2020. Deal terms got less competitive in Q4 as deal volume increased significantly but average terms across the whole year were still an improvement when compared to 2019.

Nevertheless, with insurers experiencing large losses on their ‘traditional’ lines of insurance, there could be an impact on insurer appetite and their pricing of risks. The much-anticipated price rise has not yet materialised but we may start to see insurers being more selective with respect to the transactions they underwrite and the premiums they charge as the year progresses.

Worries have been expressed about whether increased use of W&I insurance will, ultimately, drain time and resources in the event that claiming under the policies becomes difficult or protracted. Experience to date has not borne out such concerns. Having reviewed claims outcomes over the past five years, it is clear that policies are doing what they are supposed to do – protecting policyholders with efficient payments in the event of a valid claim.

There are also encouraging signs of innovation in the market, in part driven by lower deal volume in 2020 and insurers having both the time and appetite to consider potential new revenue streams. Two key examples of innovations in 2020 are policies for P2P deals and policies for secondaries deals. Looking forwards, we expect to see continued innovation in the market, alongside a continued uptick in the use of tax, title, environmental and contingent risk insurance being used more frequently alongside W&I.

'Innovation and sophisticated purchasers' behind continued W&I growth in UK deals

The use of warranty and indemnity (W&I) insurance continues to rise with insureds taking out more policies than ever before. The sustained increase in the use of insurance demonstrates that M&A insurance has simply become part of the infrastructure of deal-making, adds Caroline Rowlands, executive director of insurance advisor Howden M&A.

While certain private equity houses have been resistant to using W&I insurance on the basis that they have done deals for years without it, this approach is becoming less sustainable in the current market conditions. Given the amount of ‘dry powder’ available, compared to the relatively limited number of good quality investment opportunities, it is now more important than ever for investors to make their bids as attractive as possible. If all of the competing bidders in an auction process are using W&I insurance, and thereby offering to cap the warrantors’ liability at a nominal amount, not using insurance can become a significant disadvantage.

While certain private equity houses have been resistant to using W&I insurance on the basis that they have done deals for years without it, this approach is becoming less sustainable in the current market conditions. Given the amount of ‘dry powder’ available, compared to the relatively limited number of good quality investment opportunities, it is now more important than ever for investors to make their bids as attractive as possible. If all of the competing bidders in an auction process are using W&I insurance, and thereby offering to cap the warrantors’ liability at a nominal amount, not using insurance can become a significant disadvantage.

Having insurance streamlines transaction negotiations. Without insurance, the warranties and indemnities will be negotiated in granular detail: sellers will want them drafted narrowly, while buyers push for as broad a suite of warranties as possible. W&I insurance eases the tension in these negotiations and makes the deal a little easier to get over the line.

Historically, insurance was not used on lower cap deals or investments. However, with more insurers focusing on this end of the market, minimum premiums are coming down and take-up is on the rise.

Broadly speaking, as insurers chased fewer deals between March and September of last year, we saw average pricing and deductibles drop again in 2020. Deal terms got less competitive in Q4 as deal volume increased significantly but average terms across the whole year were still an improvement when compared to 2019.

Nevertheless, with insurers experiencing large losses on their ‘traditional’ lines of insurance, there could be an impact on insurer appetite and their pricing of risks. The much-anticipated price rise has not yet materialised but we may start to see insurers being more selective with respect to the transactions they underwrite and the premiums they charge as the year progresses.

Worries have been expressed about whether increased use of W&I insurance will, ultimately, drain time and resources in the event that claiming under the policies becomes difficult or protracted. Experience to date has not borne out such concerns. Having reviewed claims outcomes over the past five years, it is clear that policies are doing what they are supposed to do – protecting policyholders with efficient payments in the event of a valid claim.

There are also encouraging signs of innovation in the market, in part driven by lower deal volume in 2020 and insurers having both the time and appetite to consider potential new revenue streams. Two key examples of innovations in 2020 are policies for P2P deals and policies for secondaries deals.

Looking forwards, we expect to see continued innovation in the market, alongside a continued uptick in the use of tax, title, environmental and contingent risk insurance being used more frequently alongside W&I.

Average premium rates (% of the policy limit)

| Real Estate | Operational | ||

|---|---|---|---|

| 2019 | 2020 | 2019 | 2020 |

| 0.92% | 0.78% | 1.26% | 1.15% |

Typical retentions (% of Enterprise Value)

| Real Estate | Operational | ||

|---|---|---|---|

| 2019 | 2020 | 2019 | 2020 |

| Nil | Nil | 0.25%-0.5% fixed (with certain insurers beginning to offer tipping retentions on private equity backed transactions). | 0.25%-0.5% (with most insurers now offering tipping to NIL retentions on private equity transactions). |