UCITS long-short funds (‘LS funds’) are funds that seek to generate returns while minimising the impact of market volatility by taking both long and short exposure to investments, such as equities and bonds.

LS funds have grown to become an established strategy within the UCITS regime, and are of particular interest to alternative managers seeking to capitalise on the commercial opportunities that the UCITS brand presents, as well as to more traditional managers looking to expand the investment products they offer to investors.

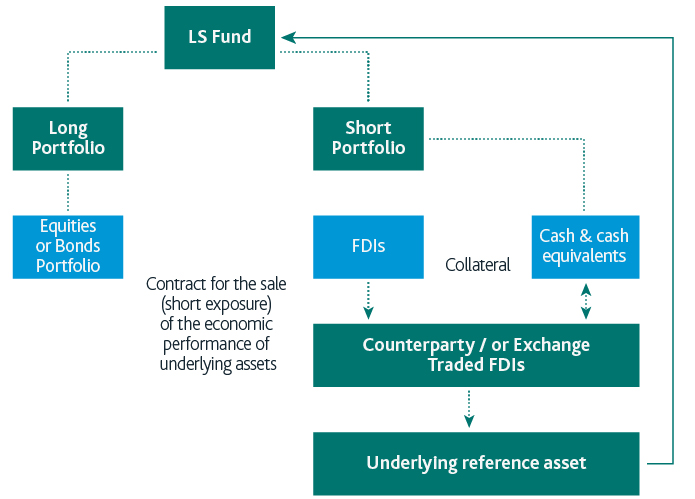

LS funds are constructed by buying a portfolio of equities or bonds – a ‘long’ portfolio - that the investment manager anticipates will increase in value over time. At the same time, the LS fund takes on short exposure to equities or bonds by investing in financial derivative instruments (FDIs) on these investments – a ‘short’ portfolio – that are anticipated to fall in value over time. The short portfolio is comprised of a combination of cash or liquid instruments and FDIs) which take short economic exposure to underlying assets such as individual equities, bonds, equity or bond indices, or baskets of equity of bond securities. The liquid portfolio is used as collateral for the short positions of the LS fund.

LS funds use FDIs – typically forwards, futures, swaps, options, or contracts for difference – for the purpose of taking short exposure to returns linked to the performance of equities or bonds. If the equities or bonds fall in value, the LS fund will generate positive investment returns.

Should UCITS LS funds be established as AIFs?

Traditionally, funds adopting a long-short investment strategy were categorised as alternative investment funds (AIFs) under the EU’s Alternative Investment Funds Managers Directive (AIFMD) regime. However, the broad range of eligible assets that UCITS may acquire means that UCITS can be established as absolute return funds, market neutral funds, or long short funds.

What type of investors are LS funds aimed at?

The UCITS regime is a respected regulatory framework and LS funds, while representing a niche segment, are popular with institutional and retail investors in the European Economic Area (EEA) – including all 27 EU countries as well as Iceland, Liechtenstein and Norway.

The growth of alternative UCITS and their marketability throughout the EEA has enabled traditional hedge fund managers to adapt their clientele, specifically by designing funds that meet the needs of both institutional and retail investors.

Synthetic prime brokerage products

Under the UCITS regulations, LS funds are not permitted to appoint a prime broker that directly lends to the LS fund for investment purposes. They also cannot borrow stocks to establish short positions and may only take short positions by investing in FDIs.

At first glance, this would appear to prevent prime brokers from providing prime brokerage services to the UCITS. However, the prime brokerage industry has developed ‘synthetic prime brokerage’ products that allow LS funds to invest in FDIs as a substitute for borrowing securities and secure margin financing which provides a leveraged exposure for the LS fund. The use of FDIs permits the LS fund to achieve both long and short exposures within the regulatory framework.

Financial regulatory requirements

The use of FDIs for investment purposes is fundamental to the investment strategies of LS funds. Like all UCITS that invest in FDIs, LS funds must comply with a number of financial regulatory requirements.

Investment in FDIs must only give an LS fund exposure to assets that the fund is permitted to invest in directly

The underlying assets of LS funds must be comprised of:

- UCITS eligible assets: transferable securities, money market instruments, units in collective investment schemes, deposits with credit institutions, FDIs that meet the requirements of the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 (UCITS Regulations) and, in Ireland, the Central Bank (Supervision and Enforcement) Act 2013 (Section 48(1)) (Undertakings for Collective Investment in Transferable Securities) Regulations 2015 (CBI UCITS Regulations), including FDIs having one or several characteristics of those assets;

- financial indices;

- interest rates;

- foreign exchange rates; or

- currencies.

FDIs must not expose the LS fund to risks which it could not otherwise assume

As an example, the FDI must not gain exposure to an instrument or issuer to which the UCITS cannot have a direct exposure.

FDIs cannot cause the LS fund to diverge from its investment objectives

The LS fund’s investment objectives will be disclosed in its prospectus.

Other requirements

The FDI must be:

- dealt on a regulated market;

- transacted with a counterparty that is an eligible credit institution;

- transacted with an investment firm authorised in accordance with the EU’s Markets in Financial Instruments Directive (Mifid), which complies with the credit rating requirements;

- transacted with a group company of an entity that complies with the credit rating requirements, and is approved as a bank holding company by the US Federal Reserve where that group company is subject to bank holding company consolidated by the Federal Reserve.

If the FDI is subject to a novation, then the new counterparty must satisfy one of these criteria or the FDI must be transacted with a central counterparty that is authorised or recognised under the EU’s OTC Derivatives, Central Counterparties and Trade Repositories Regulation (EMIR) or a third country entity recognised by ESMA pursuant to article 25 of EMIR.

FDI counterparty exposure limits

Like all UCITS, LS funds are required to comply with risk spreading rules or issuer concentration limits, which limit the investment that may be made in a single issuer to 10% of the LS fund’s net assets. These issuer concentration limits should be complied with if securities are held directly by the LS fund and if exposure to an issuer is obtained through FDIs.

In relation to FDIs, the LS fund is required to assess its exposure to an underlying issuer by using the commitment approach – where the economic exposure of each FDI is converted into the market value of an equivalent position in the underlying security, as prescribed in the UCITS regulations.

LS funds are required to limit their exposure to any single counterparty to 5% of its net asset value. This limit can be increased to 10% if the counterparty falls within the category of certain credit institutions defined in the regulations.

In assessing risk exposure to a counterparty, an LS fund:

- must calculate exposure to the counterparty using the positive mark-to-market value of the FDI entered into with the counterparty;

- may enter into legally enforceable netting arrangements in respect of over the counter (OTC) FDI with the same counterparty but not in relation to any other exposures held with that same counterparty; and

- may receive collateral to reduce exposure to the FDI counterparty, provided that collateral complies with certain eligibility requirements.

Cover requirements for FDI positions

An LS fund is required to have either cash or securities to settle its obligations under the FDI contract. Where the FDI is settled in cash, the LS fund must hold liquid assets – cash or money market instruments – as ‘cover’ to ensure that it can pay for the position it holds in the FDI. Where physical delivery of the underlying asset is required for settlement, the LS fund must hold the underlying asset, or sufficiently liquid assets where the underlying asset consists of highly liquid fixed income securities, or the LS fund considers that the exposure can be adequately covered without holding the underlying asset and details are disclosed in the LS fund prospectus.

Risk management process and risk measurement

Like all UCITS that invest in FDIs, LS funds are required to implement a detailed risk management process (RMP) that sets out how the LS fund will monitor and manage risk relating to the use of FDIs.

An LS fund may apply either the ‘commitment’ approach, or alternatively use an alternative risk measurement methodology such as the value-at-risk model (VaR). Typically, LS funds using high levels of leverage use the VaR model. The VaR model allows for a greater degree of leverage – for example, it would not be unusual for an LS fund to have a gross exposure that exceeds 500% of its net asset value.

Calculation of global exposure using the VaR approach must be carried out in accordance with the UCITS regulations. Additional requirements also apply:

- ‘back testing’ of the VaR model – a formal statistical process to compare actual portfolio returns to the VaR predicted – must be carried out on at least a monthly basis;

- regular stress tests must regularly be carried out, at least monthly, on all risks that affect the value or the fluctuations of the LS fund to any significant degree in accordance with the written stress test policy of the LS fund;

- leverage must be regularly monitored; and

- the risk profile and investment strategy, together with other risk measurement methods, must be considered.