Out-Law / Your Daily Need-To-Know

Undertakings for Collective Investment in Transferable Securities (UCITS funds) are open-ended collective investment schemes that are established under a common EU legal and regulatory framework.

UCITS were first introduced in the EU in 1985 with the aim of creating a retail investment fund that could be sold cross border in EU member states. This so-called ‘marketing passport’ is central to the UCITS product and allows asset managers to create a single European fund product without the need to establish multiple UCITS funds in each jurisdiction where the UCITS fund is distributed.

UCITS funds are subject to harmonised EU rules regarding their authorisation and supervision and are required to appoint an independent depositary who is responsible for safekeeping the assets of a UCITS fund. UCITS funds must comply with:

- detailed investment rules governing the types of assets that are eligible for investment;

- rules for the diversification and spreading of investment risk;

- liquidity requirements;

- detailed requirements regarding the monitoring and management of risks for investment in financial derivative instruments

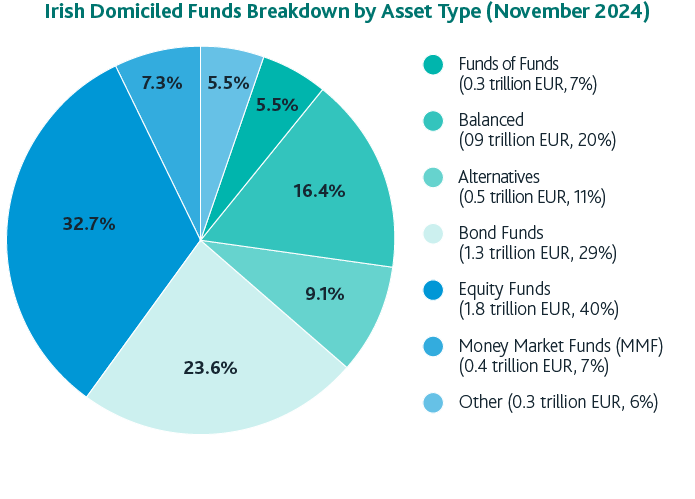

Since their introduction, UCITS funds have gone from strength to strength and are currently distributed in over 90 countries across the globe. As of February 2025, total assets under management by UCITS funds exceed €6.1 trillion. In the EU, exchange traded funds (ETFs) and money market funds (MMFs) are usually established as UCITS funds.

Over the last three decades, Ireland has earned a reputation as a leading country to manage UCITS from and/or hold assets in UCITS funds in. There are several reasons for this, which include the following:

- the Irish funds industry services over €6.3 trillion in assets and more than €4.1 trillion of fund assets are held in Irish regulated investment funds;

- 18 of the top 20 global asset managers have established Irish based UCITS funds;

- an estimated 1,045 fund promoters operate in Ireland, 582 of which are promoters of Irish based funds;

- more than 15,200 funds are serviced in Ireland, 8,612 of which are Irish based;

- there are over 35,000 people employed by the Irish funds industry, 18,400 of whom are directly employed by firms operating in the Irish funds industry – by 2027 it is expected that over 20,000 people will be directly employed by firms operating in the Irish funds industry;

- industry predictions estimate that the Irish financial services industry could expand by up to 26% by 2028;

- Ireland is an English-speaking, common law jurisdiction in the EU with long-established close connections with the UK and the US.

Below, we summarise the main features of UCITS funds and provide an overview of the main steps for establishing a UCITS fund in Ireland.

Main characteristics

UCITS funds can invest in a diverse range of investments, including the following:

- transferable securities such as equities, bonds or asset backed securities that are listed or traded on a recognised market – up to 10% of a UCITS fund’s assets may be invested in transferable securities that are not listed on a recognised market;

- money market instruments, such as commercial paper, certificates of deposit or bankers’ acceptances;

- units in collective investment schemes;

- financial derivative instruments, such as futures, forwards, swaps, and cash deposits;

- ancillary liquid assets.

UCITS funds are not permitted to invest directly in real estate, commodities, or unlisted equities of private companies.

Risk spreading

UCITS funds are required to spread investment risk and are restricted from investing more than 10% of their assets in a single investment. In addition, the sum of all investments that exceed 5% of a UCITS fund’s assets should not, in aggregate, exceed 40% of the UCITS fund’s assets. This risk spreading rule is known as the ‘5/10/40’ rule.

Liquidity

The securities that a UCITS fund acquires should be sufficiently liquid to ensure that the UCITS fund will be able to repurchase shares/units at the request of investors.

Borrowing

UCITS funds may borrow up to 10% of their net assets for treasury or liquidity management purposes. However, borrowing to finance the purchase of investments is not permitted.

Leverage

Through investment in financial derivative instruments, UCITS funds may employ leverage and leverage exposure may be several multiples of the value of a UCITS fund’s assets. Leverage is required to be monitored and controlled in accordance with detailed risk management procedures.

Dealing by investors

UCITS funds must allow investors to subscribe and redeem units on a frequent basis. Although the UCITS regulations require dealing at least once per fortnight, typically UCITS funds are established to accommodate daily dealing by investors.

Choice of fund vehicles

UCITS funds can be established as an Irish collective asset management vehicle (ICAV), a variable capital investment company, a unit trust, or a common contractual fund (CCF).

Regulated service providers

The provision of fund management, depositary, investment management and administration services to UCITS funds is highly regulated. Firms seeking to provide these services must be authorised by the Central Bank of Ireland (Central Bank) or an equivalent regulatory authority in their place of establishment.

Retail investors

UCITS funds are suitable for investment by retail investors. Those investors are not required, under the UCITS regulations, to comply with eligibility criteria or to comply with minimum subscription requirements. However, minimum subscription levels are often adopted voluntarily.

Marketing passport

UCITS funds are able to obtain a European marketing passport. This means that a UCITS fund that is authorised in Ireland can be marketed and distributed to retail investors in every country across the EU and European Economic Area (EEA).

Key information document (KID)

UCITS funds are required to publish a KID, which is a simplified product factsheet that summarises, in plain English, the investment objective and policy. The KID also discloses past performance data, specifies an ongoing charges figure, and includes a risk-reward indicator for the UCITS fund.

Investment strategies

A UCITS fund is a flexible type of investment fund that can accommodate many diverse types of investment strategies. Of particular importance is the ability of asset managers to use financial derivative instruments (FDI) to implement investment strategies that were previously the preserve of hedge fund managers. The opportunity to structure alternative investment strategies within the robust UCITS regulatory framework has been critical to the growth of the UCITS product.

Examples of investment strategies that are being implemented by UCITS include:

- absolute return funds;

- long/short equity funds;

- statistical arbitrage;

- convertible arbitrage;

- global macro;

- market neutral;

- fixed income arbitrage;

- convertible bond;

- money market;

- commodities index funds;

- ETFs;

- fund of funds;

- enhanced fixed income;

- structured products;

- managed futures;

- credit funds;

- hedge fund index funds;

- master-feeder funds.

Fund vehicles

Sponsors may choose from different types of vehicles for the operation of their UCITS funds. UCITS funds may be established as one of the following:

- Irish collective asset-management vehicle (ICAV);

- Variable capital investment company (Investment company);

- Unit trust;

- Common contractual fund (CCF).

Unit trusts and CCFs are required to appoint a UCITS management company. An ICAV and an investment company can choose between appointing a management company or operating on a self-managed basis.

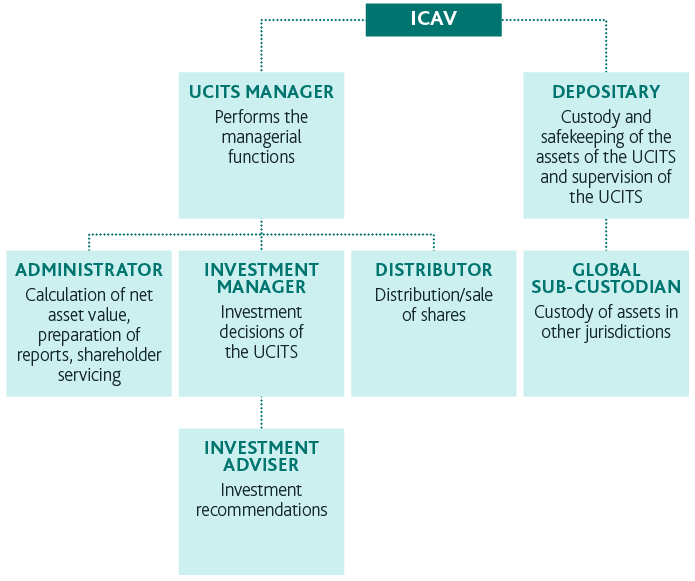

ICAV

An ICAV is a type of corporate vehicle that operates under legislation designed specifically to meet the operational needs of investment funds, their managers and investors. An ICAV is governed by the Irish Collective Asset-management Vehicles Act 2015 and it avoids the application of company law legislation that is not relevant to UCITS funds.

A main advantage of the ICAV is that although it constitutes a corporate entity, it can nonetheless elect to be classified under the US federal tax rules as either a tax transparent vehicle or a tax opaque vehicle.

In comparison to a variable capital investment company, the ICAV is a more administratively efficient vehicle that has the following benefits:

- it may produce audited accounts per sub-fund;

- it may dispense with the requirement to hold AGMs; and

- it is permitted to make non-material amendments to its constitution without the requirement for shareholder approval.

Investment company

An investment company is a public limited liability company that is subject to the Irish Companies Act 2014 (as amended), save to the extent that the Companies Act is disapplied by the UCITS Regulations or by the Companies Act 2014 itself.

An investment company is a corporate vehicle that has its own legal personality, which can enter into contracts in its own name, and is managed and governed by its board of directors.

The paid-up share capital of an investment company must always equal its net asset value. This means the shares of an investment company have no par value and fluctuate in value in accordance with the value of the investment company’s investments. Shareholders of an investment company have limited liability and the investments of the UCITS fund are owned by the investment company itself.

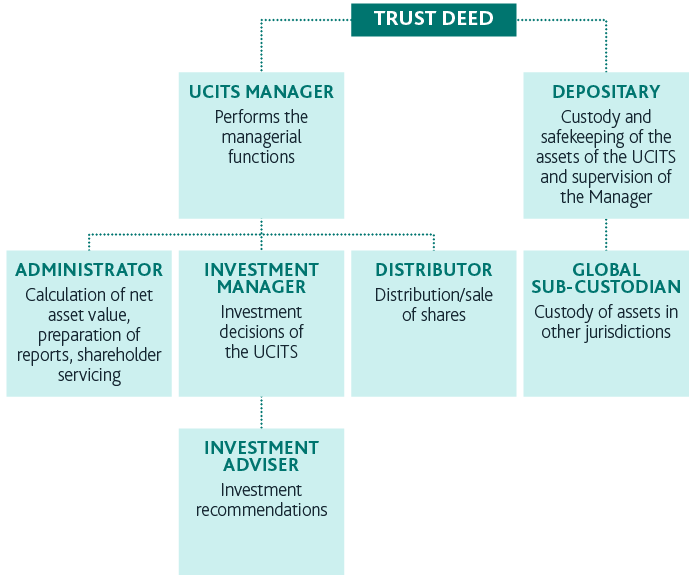

Unit trust

A unit trust is constituted under trust law by a trust deed entered into between the depositary and the UCITS manager. The UCITS manager is responsible for the management and administration of the assets of the unit trust on behalf of investors. The depositary is registered as the legal owner of the assets of the unit trust on behalf of the investors, who receive units, which represents a beneficial interest in the unit trust’s assets.

A unit trust can only act through its UCITS manager or depositary. Contracts for the management and administration of the unit trust are entered into by the UCITS manager, whereas the depositary will enter into contracts for the unit trust’s assets, such as charge, lien, or other security agreements.

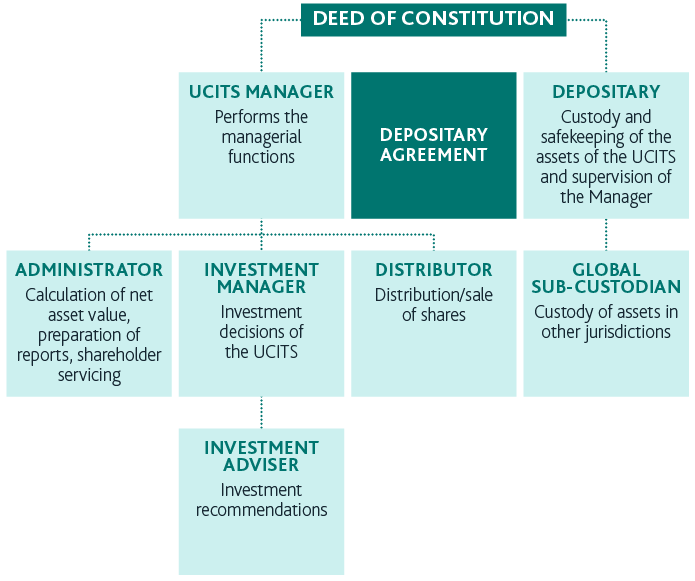

Common contractual fund (CCF)

A CCF is constituted under contract law by way of deed of constitution (deed) entered into between the UCITS manager and the depositary. Under the deed, the UCITS manager is responsible for the management and administration of the CCF on behalf of investors. The deed specifies the fiduciary responsibilities of the depositary. The depositary will be appointed to provide for the safekeeping of the CCF’s assets under the terms of a depositary agreement entered into between the UCITS manager and the depositary.

A CCF does not have its own legal personality, it can only act through its UCITS manager or depositary. A CCF’s investors participate and share in the property of the CCF as co-owners of the assets of the CCF. As a co-owner, each investor holds an undivided co-ownership interest as a tenant in common with the other investors.

The main feature which differentiates CCFs from other type fund vehicle is that a CCF is fully tax transparent, so that investors are treated as if they own a proportionate share of the underlying investments of the CCF rather than units in an undertaking that owns the investments.

Service providers

UCITS management company (Manco)

A UCITS Manco will be appointed by the board of the ICAV or the investment company, or in the case of a Unit trust or CCF, it will be the manager to the UCITS fund. A UCITS Manco is responsible for managing UCITS funds. Those functions include investment management, risk management, administration, and marketing. It is possible for a UCITS Manco to delegate some or many of these functions, provided it retains sufficient substance for its operations in Ireland and maintains a minimum headcount of at least four full time employees or equivalent, so that it is not considered to be a so-called “letter-box entity”.

A UCITS Manco is required to adopt a business plan setting out its organisational structure, the responsibilities of its senior management, and information on how it intends to comply with its obligations under Irish law. Under a business plan, the UCITS Manco is responsible for the following key designated managerial functions:

- regulatory compliance;

- fund risk management;

- ·operational risk management;

- investment management;

- capital and financial management;

- distribution.

A UCITS Manco must have designated persons who are responsible for the above managerial functions. The designated person responsible for the investment management function is not permitted to also be responsible for the fund risk management function or operational risk management function. Designated persons can be an employee of the UCITS Manco. Alternatively, a suitably qualified person can be seconded to act as designated person on behalf of the UCITS Manco.

Investment manager

Sometimes the UCITS Manco will not assume responsibility for the discretionary management of the UCITS fund’s investments and therefore it is necessary to appoint an investment manager that will undertake responsibility for discretionary portfolio management. The function of the investment manager is to undertake day-to-day investment decision making on behalf of the UCITS fund.

The UCITS Directive provides that only investment firms that are authorised for the purpose of asset management, and which are subject to prudential supervision under a regulatory regime that is broadly equivalent to EU standards, may be appointed to act as a discretionary investment manager of UCITS funds. Accordingly, European authorised investment managers that meet certain requirements – for example, that are authorised under the MiFID Directive – are not subject to an approval process.

The Central Bank will, however, require confirmation from the home state regulator that the investment manager has the appropriate regulatory status.

Where the UCITS fund proposes to delegate discretionary investment management to an investment firm based in a third country, cooperation between the Central Bank and the supervisory authority of the investment firm must be ensured. The Central Bank has accepted several jurisdictions as having a comparable regulatory regime. They include: Abu Dhabi; Australia; Bahamas; Bermuda; Brazil; Canada; Dubai; Guernsey; Hong Kong; India; Japan; Jersey; Malaysia; Qatar; Singapore; South Africa; South Korea; Switzerland; and the US.

The Central Bank will apply an approval process to ensure that the investment firm is subject to regulation and ongoing prudential supervision that is equivalent to EU standards. The Central Bank’s approval process requires the completion of an application form by the prospective investment manager and requires the filing of the investment manager’s audited accounts.

Depositary

The depositary is responsible for holding and safekeeping the assets of a UCITS fund. Strict obligations are imposed on the depositary relating to monitoring cash flow, safekeeping of assets and detailed oversight, verification, and monitoring obligations.

The depositary is also subject to strict liability for loss of a financial instrument held in custody, unless proven that the loss arose by virtue of an external event beyond the depositary’s reasonable control. This strict liability affords investors in a UCITS fund a strong level of protection. The depositary is also liable to the UCITS fund and its investors for all losses suffered due to the negligence or intentional failure by the depositary to properly fulfil its obligations under the UCITS Regulations.

In addition, there are stringent rules regarding delegation and the depositary must comply with minimum ongoing monitoring requirements for any delegates.

Administrator

An administrator, which is authorised by the Central Bank to conduct administration activities, must be appointed to provide administration services to an Irish authorised UCITS fund. The Central Bank imposes rules on the outsourcing of administration activities, intended to promote greater consistency and certainty. While the outsourcing of certain activities is permitted, “core administration activities” such as the final checking and release of the net asset value per unit/share, as well as the maintenance of the shareholder register, cannot be outsourced.

Directors

An ICAV, an investment company or a UCITS Manco must have at least two Irish resident directors, which are required to be pre-approved by the Central Bank. All directors need to comply with the Central Bank’s fitness and probity requirements (the F&P requirements).

The F&P Requirements require the collation of certain due diligence for each director and the filing of an individual questionnaire (IQ) with the Central Bank. The F&P requirements allow the Central Bank to satisfy itself that the proposed directors are: competent and capable; honest, ethical and will act with integrity; and financially sound.

The time it takes to nominate suitable directors and obtain their approval is a process that can take weeks to complete and should be considered as part of the authorisation timetable.

Taxation of UCITS funds

Fund level taxes

UCITS funds are subject to Ireland’s favourable tax regime for investment funds. In particular, UCITS funds are exempt from Irish tax on income and gains derived from their investment portfolios and are not subject to any Irish tax on their net asset value. UCITS funds do not charge any withholding taxes on payments to investors, and no stamp or capital duty is payable in Ireland on the issue, transfer, repurchase, or redemption of units/shares in a UCITS fund.

No withholding taxes

No Irish withholding taxes apply to the payment of dividends or distributions to investors who are not resident in Ireland and have provided the UCITS fund with the appropriate tax residence declaration. The payment of redemption proceeds, returns of capital or payments in relation to the encashment, cancellation, or transfer of units to non-Irish resident investors, are also exempt from Irish withholding taxes.

Stamp duty and subscription taxes

No stamp duty is payable in Ireland on the issue, transfer, repurchase or redemption of shares in a UCITS fund. No subscription taxes are levied by the Irish tax authorities on the assets of a UCITS fund.

Treaty access

Ireland has an extensive network of double taxation treaties and the Irish tax authorities consider that UCITS funds, other than CCFs, are generally entitled to the benefit of Ireland’s extensive tax treaty network. The availability of treaty benefits may enable a UCITS fund to avail of reduced rates of foreign withholding tax that would otherwise apply to the holding of foreign assets. Tax treaty access can be restricted depending on the provisions of relevant tax treaty and the approach of the tax authorities in the treaty country where the UCITS investments are located.

Election for US tax purposes

A UCITS fund that is established as an ICAV can elect to ‘check-the-box,’ which under US tax regulation operates to classify the ICAV as a partnership or a disregarded entity for US federal tax purposes. This feature can enhance the attractiveness of the ICAV for US taxable investors, who generally prefer to invest in tax transparent vehicles. An ICAV is subject to the same domestic tax treatment as other corporate funds – i.e. there is no Irish tax on its income or gains, and no Irish withholding taxes or stamp duty applies.

VAT

The provision of certain standard services to Irish UCITS funds, such as investment management, administration, transfer agency and depositary services, are treated as VAT exempt in Ireland. Other services, such as legal and accounting services, can result in a liability for Irish VAT. UCITS funds can, however, recover such VAT charges based on the VAT recovery rate, which is calculated on the proportion of the UCITS fund’s investments located outside the EU, or alternatively based on the portion of investors that are located outside the EU.

Distribution

UCITS funds benefit from a harmonised legal framework whereby a UCITS fund that is established in Ireland can, following the completion of a notification procedure, be sold cross border in another EEA member state without the need for additional authorisation. Furthermore, UCITS funds are often recognised by regulators in markets in the Middle East, Latin America, and Asia.

The procedure for the notification of the marketing of a UCITS fund in another jurisdiction is relatively straightforward and requires the UCITS fund to submit a standard notification together with supporting documentation to the Central Bank.

Once a complete notification is received, the Central Bank will review the notification, and if it is satisfied with all the documents, they will forward this notification to the host state regulator within 10 working days.

Usually, marketing of the UCITS fund can commence immediately following receipt of the confirmation from the Central Bank that it has transmitted the notification to the host state regulator. Under the UCITS regulations, EU member states are prohibited from imposing additional requirements and it is only the key investor information document (KIID) that is required to be translated, which is a change from the previous requirements that had resulted in costly translation expenses.

The UCITS fund has been hugely successful since its inception and has developed into a global brand that has strong market penetration in jurisdictions outside of the EU. The procedure for distributing UCITS funds outside of the EEA is country specific and distribution needs to be considered on a jurisdiction-by-jurisdiction basis.

However, due to the high level of investor protection afforded by UCITS funds, typically, UCITS funds are treated as regulated retail funds for the purposes of registration in jurisdictions outside the EEA – indeed, some jurisdictions outside of the EU have a specific ‘fast-track’ approval process for UCITS funds. UCITS funds can be registered for public distribution in non-EU jurisdictions, such as Switzerland, Singapore, Hong Kong, Macau, Taiwan, Chile, Peru, South Africa, and Bahrain, where UCITS funds have developed strong brand awareness and market recognition.

To date UCITS funds are distributed to over 90 countries worldwide.

Regulatory approval process and timeframe

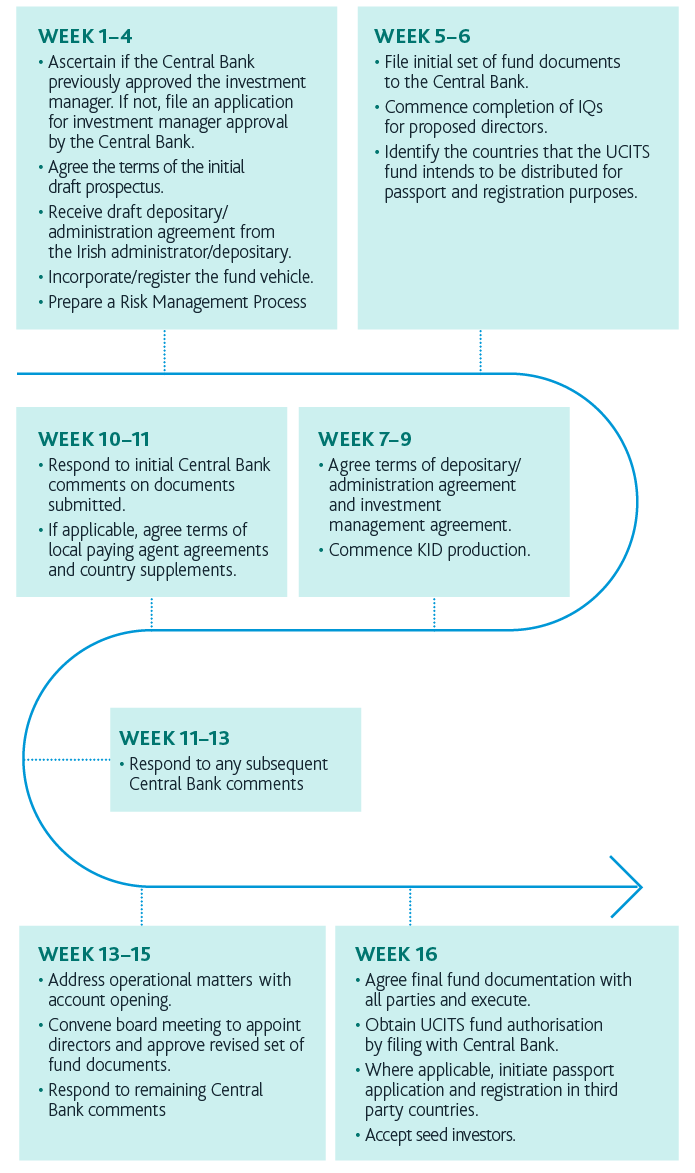

Depending on its nature and complexity, we normally advise that a realistic timeframe for the authorisation of a UCITS fund is a period of between 12 to 16 weeks from the date we are requested to commence the initial filing with the Central Bank.

The procedure for the authorisation of a UCITS fund involves obtaining the Central Bank’s approval of the directors and the investment manager of the UCITS fund, as well completing the Central Bank’s review and approval of core fund documents, primarily the prospectus.

The review and approval of the core fund documents commences with an initial application being filed with the Central Bank. The Central Bank has 20 working days from the date of the submission of this application to issue its comments. Once those comments are received and responded to, the Central Bank has 10 working days to review the responses and issue any additional comments. This review and comments process will continue until the Central Bank confirms that it has no further comments. At that point, the application for authorisation of the UCITS fund can be submitted to the Central Bank.

There are many other documents, such as investment management agreement, administration agreement, depositary agreement, distribution agreement, and letters of confirmation, among others, that need to be filed with the Central Bank for authorisation purposes. For these documents, the Central Bank requires the UCITS fund’s legal advisers to certify compliance with the UCITS Regulations, and these documents are filed with the Central Bank immediately prior to authorisation of the UCITS fund.

The main benefits of a UCITS

Regulated product and branding

A UCITS fund is a regulated investment fund that is subject to the prudential supervision of the Central Bank. The benefits of being highly regulated include a strong level of investor protection and favourable branding that comes from being established as a regulated investment fund.

Marketing passport

UCITS funds can avail of the marketing passport and can make a pan-European offering of their shares to investors throughout the EU and EEA.

Favourable tax regime

UCITS funds are subject to Ireland’s favourable tax regime for investment funds. In summary, UCITS funds are not subject to Irish income or capital gains taxes on their investments. In addition, non-Irish resident investors are not subject to any taxes on dividends, distributions or on a redemption or encashment of shares by a UCITS fund. UCITS funds established as an ICAV, or investment company are legal persons that are tax resident in Ireland. They can normally access Ireland’s extensive network of double tax treaty agreements, which may allow the UCITS fund to avail of reduced rates of foreign withholding taxes on foreign sourced income.

Choice of fund vehicle

UCITS funds may be established under different legal structures such as an Irish collective asset management vehicle (ICAV), a variable capital investment company, a common contractual fund, or a unit trust.

Centre of excellence

Ireland is the largest fund administration centre in the world with more than €6.3 trillion assets under administration. The total level of assets of Irish based funds exceeds €4.676 trillion.

Ireland’s attraction as a base for funds is due to a combination of the Irish legal and regulatory system, the specialist skills and expertise of its workforce, Ireland’s pro-business approach, infrastructure, competitive tax environment and government support.