Last updated in June 2015.

These regulations have opened up the opportunity to establish a whole range of business supportive entities that previously were not considered possible in Qatar. Indeed many of these entities that were previously incorporated overseas are now being on-shored back to Qatar, benefitting Qatar and enabling better control over their operation.

Holding companies

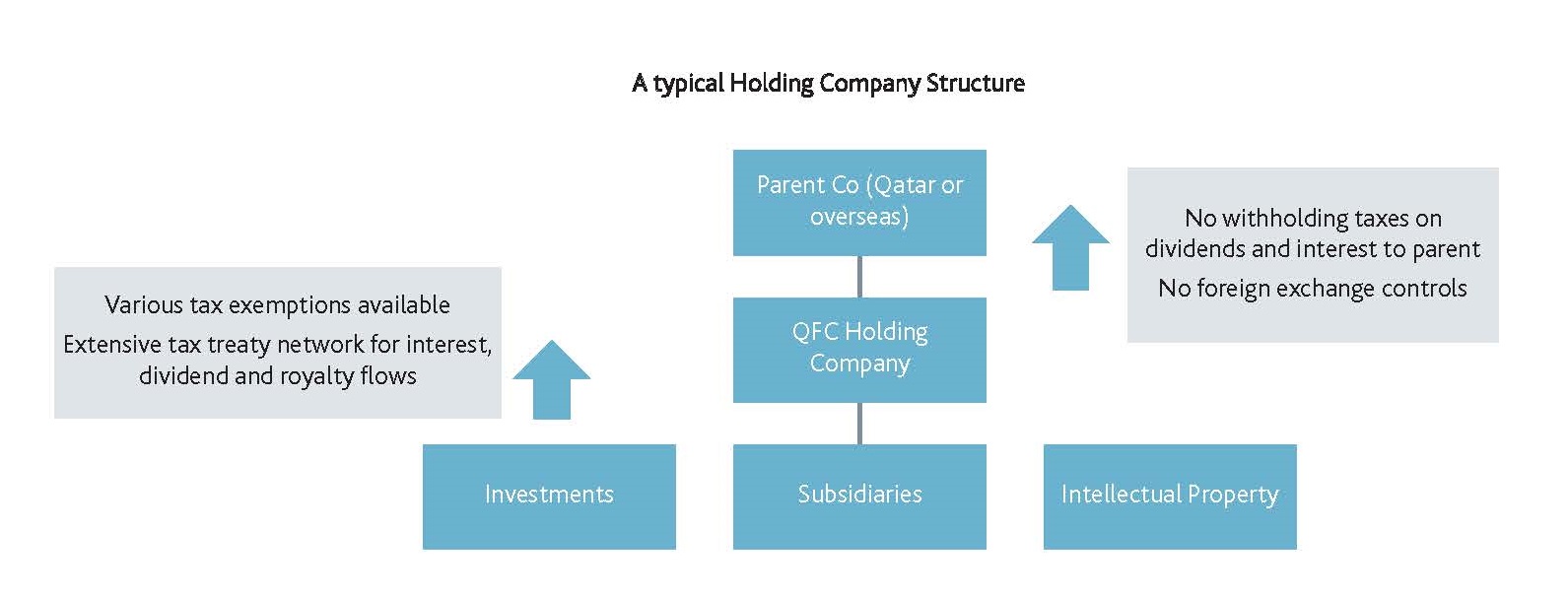

International groups establishing a presence in the region, and local companies looking to expand their interests outside of Qatar can now easily establish a holding company in the QFC. In addition to holding group subsidiaries the company can provide a full range of treasury support services, hold other investments and manage and hold the rights to intellectual property used by its subsidiaries.

A typical Holding Company Structure

The Holding Company can be held 100% by its parent, have full access to the local market and support services and there are no restrictions on currency of operation and the repatriation of profits.

Special Purpose Companies (SPCs)

SPCs have been used extensively by businesses in Qatar for a variety of purposes including asset financing transactions, securitisations, sukuk issues and leasing but until recently the vast majority of these entities were established in overseas jurisdictions, remote from Qatar. They can now be set up quickly and efficiently in the QFC.

A simplified funding transaction incorporating a QFC SPC

The application fee for the establishment of an SPC is $5,000 with an annual fee of $500. There is no need to have an audit, file financial statements or hold an annual general meeting. Every SPC must appoint a support service provider but the majority of the support to the entity can be provided by other group companies in Qatar, if any.

Taxation advantages

• Low tax environment with tax exemption for dividends from subsidiaries and gains on share disposals

• Complete exemption from taxation on certain activities for both Holdcos and SPCs

• Advance tax rulings service to provide certainty

• Benefit from Qatar’s extensive tax treaty network

• No withholding taxes on dividends, interest or royalties paid by the QFC entity.

Legal environment

• QFC has its own legal environment based on English common law

• Access to an independent judiciary.

Establishing a special company

There are a number of steps required to establish a special company in the QFC. However with the right support these entities can be set up in a very short time frame.