OUT-LAW NEWS 2 min. read

Termination rights lead cloud contract concerns in financial services

Davide Catoni /iStock.

08 Dec 2025, 10:26 am

The ability to end contracts without causing disruption to customer services is the main “contractual friction point” for financial institutions when negotiating contracts with cloud service providers, according to a study led by Pinsent Masons.

Pinsent Masons worked with the Financial Regulation Innovation Lab (FRIL) (registration required) to explore how attitudes, practices and regulation relevant to the use of cloud-based infrastructure and services have moved on within the financial services sector since 2016. Back then, Pinsent Masons collaborated with UK Finance on a study that highlighted the challenges that banks faced when migrating systems and data to the cloud.

The latest study identified a significant shift in perceptions. For example, business leaders from organisations operating within the financial services sector said that scale, security and efficiencies – not cost savings – are now the primary drivers cloud of adoption in financial services, and that many of the barriers previously identified to cloud adoption, such as over whether their older systems can be successfully integrated into the cloud environment and over data security, are “no longer seen as insurmountable blockers”.

Read more on cloud adoption in financial services

- Barriers to cloud adoption diminish for financial institutions

- Scale, security and efficiency drive cloud adoption in financial services

- Financial institutions ‘must learn cloud lessons’ for next tech wave

- The full Pinsent Masons/FIRL report (registration required)

The new report on their study published by Pinsent Masons and FRIL also reflects on changes to vendor dynamics in the market over the past decade – from the “deep dependency” financial services firms now have on hyperscale cloud providers, to the challenges firms face in integrating other technological solutions provided by other cloud providers.

One issue that the report explored is the ease with which financial institutions, in the context of seeking to achieve regulatory compliance, find navigating the different contractual models operated by cloud providers.

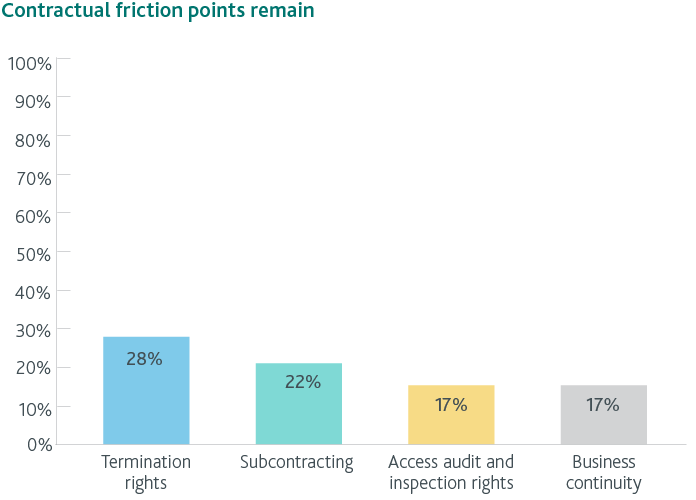

In this respect, the study found that specific contractual and operational clauses dealing with termination rights and subcontracting are the cause of greatest concern to financial service firms adopting cloud solutions – 28% of survey respondents rated termination rights as either an important or very important contractual friction point, compared with 22% of respondents in respect of subcontracting.

“These figures validate the ongoing struggles with exit strategies and the need for greater visibility and control over vendor supply chains – key friction points that persist in cloud contracting negotiations,” the report said.

Other clauses highlighted as causing friction in contract negotiations include those that address access, audit and inspection rights, and business continuity.

Luke Scanlon of Pinsent Masons said: “Termination and exit arrangements remain key friction points because they sit at the intersection of regulatory compliance and operational reality. The legal task is to bridge that gap and draft exit arrangements that are not just theoretically sound for the regulator but are also practically workable for the business without causing severe service interruptions or failing to go beyond simply rights to receive data.”

“The data regarding subcontracting concerns reflects a maturing market that is being forced by the regulators to look more so in the direction of the risks of supply chain opacity. Financial institutions remain responsible for their operational resilience and need to think through the extent of their reliance on fourth and fifth parties they cannot see. We are seeing a distinct shift where financial regulators are demanding greater visibility and control over subcontracts,” he added.