Out-Law / Your Daily Need-To-Know

Managers seeking to establish a fund for investment in private equity, infrastructure, private credit, real estate or other alternative investments can establish a regulated fund in Ireland known as a qualifying investor alternative investment fund, or QIAIF.

In this guide, we provide an overview of the QIAIF, outline the QIAIF’s principal features, and explain how a QIAIF is established.

Regulatory status

A QIAIF is restricted to professional investors, who are subject to a minimum initial subscription requirement of €100,000, or its foreign currency equivalent, and are subject to certain eligibility criteria, as described below. The Central Bank of Ireland (Central Bank) provides an exemption from the minimum subscription requirement of €100,000 and qualifying investor criteria for “knowledgeable persons”, meaning persons who are involved in the management of the QIAIF, as further described below.

Qualifying investors

QIAIFs are eligible for investment by qualifying investors. A qualifying investor is someone who:

- is defined as a professional client under the EU’s Markets in Financial Instruments Directive (MiFID); or

- receives an appraisal from an EU credit institution, a MiFID firm or a undertakings for collective investment in transferable securities (UCITS) management company that the investor has the appropriate expertise, experience and knowledge to adequately understand the investment; or

- certifies that they are an informed investor such that either: they have knowledge and experience in financial and business matters to enable evaluation of the merits and risks of the prospective investment; or their business involves, whether as principal or agent, the management, acquisition or disposal of property of the same kind as the property of the QIAIF.

Knowledgeable person exemption

The Central Bank provides an exemption from the minimum subscription amount and qualifying investor criteria in the case of the following persons/entities:

- the alternative investment fund manager (AIFM) or management company;

- a company appointed to provide investment management or advisory services to the QIAIF;

- a director of the AIFM, management company, investment company or a director of a company appointed to provide investment management or advisory services to the QIAIF;

- an employee of the AIFM, management company or investment company, or an employee of a company appointed to provide investment management or advisory services to the fund, where the employee is directly involved in the investment activities of the QIAIF or is a senior employee of the company and has experience in the provision of investment management services.

Legal structures

A QIAIF can be established as one of five different types of vehicle:

- Irish collective asset-management vehicle (ICAV) – this is a corporate vehicle that is customised for investment funds. It is broadly similar to the OEIC in the UK or the SICAV in Luxembourg. An ICAV can check-the-box for US federal tax purposes, which means that the ICAV may be treated as a tax transparent entity for US tax purposes, which may result in more favourable tax treatment in the US for tax exempt investors. However, US tax advice should be sought in this respect.

- Investment limited partnership – this is a common law partnership that is constituted under a limited partnership agreement (LPA) that is entered into by at least one general partner (GP) and one or more limited partners (LPs). An ILP is suitable for private equity funds and is a tax transparent vehicle.

- Unit trust – this is a contractual-type vehicle that is constituted under a trust deed between the manager/AIFM and the depositary. A unit trust does not have a separate legal existence; it is represented by its AIFM and its depositary.

- Common contractual fund (CCF) – this is an unincorporated body constituted under a deed of constitution between the AIFM and the depositary. A CCF does not have a separate legal personality and is represented by its manager/AIFM. The investors in a CCF participate as co-owners of the assets of the CCF/QIAIF.

- Variable capital investment company (VCC) – this is a corporate vehicle that is established under the Irish Companies Act 2014 as amended and is similar to an ICAV. The VCC has been replaced by the ICAV and therefore we recommend that new funds be established as an ICAV, ILP, unit trust, or CCF.

There are relative merits to establishing the QIAIF as an ICAV, ILP, unit trust, or other type of investment vehicle. Pinsent Masons can provide advice in this regard, including in relation to tax considerations.

Parties to a QIAIF

AIFM – manager to the QIAIF

In accordance with the Central Bank’s AIF Rulebook, a manager, referred to as an AIFM, is appointed to the QIAIF and assumes responsibility for the QIAIF’s day to day management. Normally, a QIAIF appoints an EU AIFM authorised under AIFM Directive (AIFMD) that is responsible for carrying out discretionary portfolio management and risk management. There are many third-party AIFMs for hire in the Irish market and they may be appointed as the AIFM to a QIAIF. Both an Irish AIFM and EU-authorised AIFM can avail of the AIFMD marketing passport that permits the QIAIF – subject to notification by the AIFM to its regulatory authority – to be offered to professional investors in the European Economic Area (EEA).

It is also possible for a QIAIF to appoint a non-EU AIFM as its manager. In this scenario, the non-EU AIFM, and consequently the QIAIF, is not eligible to avail of the marketing passport within the EEA. Pinsent Masons can provide guidance regarding the options for the appointment of an AIFM to a QIAIF.

Investment manager

Often an AIFM will not assume responsibility for the discretionary management of the QIAIF’s investments and therefore it is necessary to appoint an investment manager to undertake responsibility for discretionary portfolio management. The function of the investment manager is to undertake day-to-day investment decisions on behalf of the AIFM for the benefit of the QIAIF.

The AIFMD regulations provides that only investment firms that are authorised for the purpose of asset management and are subject to prudential supervision under a regulatory regime considered to be broadly equivalent to EU standards can act as a discretionary investment manager to a QIAIF. Accordingly, EU authorised investment managers that are authorised under the MiFID Directive are not subject to an approval process. The Central Bank will, however, require confirmation from the home state regulator that the investment manager is authorised as a MiFID firm.

Where the AIFM proposes to delegate discretionary investment management to a third-country firm, cooperation between the Central Bank and the supervisory authority of the investment firm must be ensured. Furthermore, the Central Bank applies an approval process to ensure that the third-country firm is subject to regulation and ongoing prudential supervision that is considered equivalent to EU standards. The Central Bank’s approval process requires an application form to be completed by the proposed investment manager and requires the filing of the investment manager’s audited accounts and other relevant documents. The Central Bank considers several jurisdictions to have a comparable regulatory regime, including Australia; Bermuda; Brazil; Canada; Dubai; Guernsey; Hong Kong; India; Japan; Jersey; Singapore; South Africa; South Korea; Switzerland; the UK; and the US.

Investment adviser

The AIFM may appoint a firm to act as investment adviser to a QIAIF. For private equity funds, the investment adviser is often the sponsor of the QIAIF which, in consultation with the AIFM, implements the investment strategy and is paid a performance fee or carried interest. There is no requirement for the investment adviser to be regulated, provided the investment adviser’s role is limited to the provision of investment recommendations to the AIFM and does not have discretionary authority over investment of the QIAIF’s assets.

Directors

A QIAIF that is established as ICAV, or the GP to an ILP, must have at least two Irish resident directors, which are required to be pre-approved by the Central Bank. The directors are required to comply with the Central Bank’s fitness and probity requirements (F&P requirements). The F&P requirements require the collation of certain due diligence for each director and the filing of an individual questionnaire (IQ) with the Central Bank. The F&P requirements allow the Central Bank to satisfy itself that the proposed directors are: competent and capable; honest, ethical and will act with integrity; and financially sound.

To nominate suitable directors and obtain their approval is a process that can take a couple of weeks to complete and therefore should be taken into account as part of the authorisation timetable.

Depositary

A depositary is responsible for the safekeeping of a QIAIF’s assets. Strict obligations are imposed on a depositary relating to monitoring cash flows, safekeeping of assets and detailed oversight, verification and asset monitoring obligations.

The depositary is also subject to strict liability in respect of loss of financial instruments held in custody, unless proven that the loss arose by virtue of an external event beyond the depositary’s reasonable control. This strict liability affords investors in a QIAIF a strong level of protection.

The depositary may also be liable to a QIAIF and its investors for losses suffered as a result of negligent or intentional failure to properly fulfil the depositary’s obligations under the AIFM regulations. There are also stringent rules regarding delegation, and a depositary must comply with specified, minimum ongoing monitoring requirements regarding delegates.

Administrator

An Irish administrator is required to be appointed to provide administration services to a QIAIF. The Central Bank imposes rules relating to the outsourcing of administration activities, which are intended to promote an enhanced level of consistency, quality and certainty of administration services.

While the outsourcing of certain administration activities is permitted, “core administration activities”, such as the final checking and release of the net asset value calculation, and the maintenance of the shareholder register, are not permitted to be outsourced.

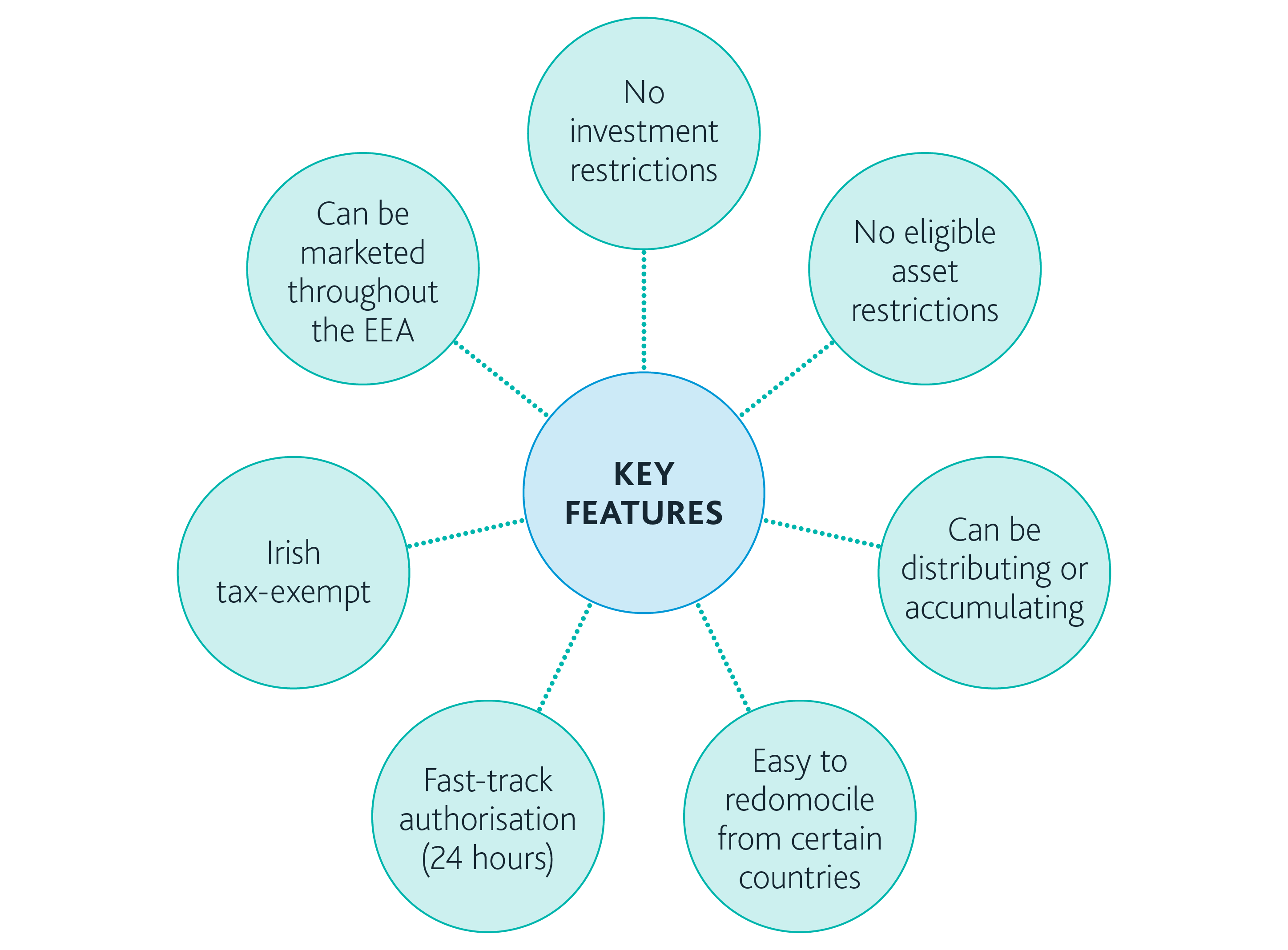

The main features of a QIAIF

Umbrella structure

A QIAIF can be established as an umbrella fund with one or more sub-funds. The rationale for using an umbrella fund is to offer investors a variety of different funds or products within a single vehicle, such as an ICAV or an ILP, and to benefit from the reduction in the fund formation timeframe and costs for the establishment of additional sub-funds.

Each sub-fund holds a separate pool of assets. Under Irish law, the assets and liabilities of one sub-fund are legally segregated from the assets and liabilities of another sub-fund. An investor purchases shares/units of a particular sub-fund. Normally, we recommend that our clients establish the QIAIF as an umbrella vehicle so that the promoter will have the flexibility to establish new sub-funds in the future.

Investment restrictions

A QIAIF is not subject to material investment restrictions that limit the types of property or investments that a QIAIF may acquire. However, a QIAIF that proposes to invest in Irish real estate or digital assets is required to file a pre-submission with the Central Bank. Aside from these investments, QIAIFs can invest in or take exposure to any asset class and can be established as real estate funds, private equity funds, credit funds, hedge funds, feeder funds, loan origination funds etc.

QIAIFs that are established as private equity or venture capital schemes are permitted to exercise management control over their investment in investee companies provided the private placement memorandum discloses the QIAIF’s intention regarding the exercise of legal and management control over its investments.

QIAIFs, except where established as loan origination funds, are not permitted to grant loans or to act as a guarantor on behalf of a third party. However, this does not prevent a QIAIF from acquiring debt securities.

QIAIFs can be established as loan origination funds that are subject to the Central Bank AIF Rulebook and rules relating to loan origination activity.

QIAIFs are not permitted to raise capital from the public through the issuance of debt securities. However, this does not prevent an QIAIF from issuing notes, on a private basis, to a lending institution to facilitate financing arrangements. Should the QIAIF wish to issue notes for such a purpose, details of the notes issued must be clearly disclosed in the QIAIF’s prospectus.

Borrowing limits

QIAIFs are not subject to any borrowing or leverage restrictions. However, the AIFMD regulations require that details of maximum level of leverage and collateral or asset re-use arrangements, if any, be disclosed in the prospectus.

Private equity and venture capital schemes

QIAIFs that are established as private equity or venture capital schemes are permitted to exercise management control over their investment in private companies provided the prospectus of the QIAIF discloses the QIAIF’s intention regarding the exercise of legal and management control over its underlying investments.

Master-feeder structures

Following the introduction of the AIFMD in Ireland, a QIAIF can be established as a feeder fund that invests all of its assets in an unregulated master fund, such as a Cayman Islands exempted limited partnership or a Delaware limited partnership. A QIAIF that invests more than 50% of its net assets in an unregulated master fund is required to: impose a minimum subscription requirement of €500,000 per investor, and; provide detailed disclosure in its prospectus of all of the conditions applicable to the QIAIF and its AIFM that are not applicable to the master fund.

QIAIF fund of funds

QIAIF fund of funds can invest in regulated or unregulated funds, which may be open-ended, limited liquidity or closed-ended funds domiciled in any jurisdiction – for example, the Bahamas, Bermuda, the British Virgin Islands, the Cayman Islands, Guernsey, Ireland, Jersey, Malta, Luxembourg, Singapore, Hong Kong, Japan, South Africa, and the US. There are no restrictions on investing in underlying funds which are leveraged, nor are any limits imposed on the amount of leverage used by underlying funds.

Taxation of QIAIFs

Fund level taxes

QIAIFs are subject to Ireland’s favourable tax regime for investment funds. In particular, QIAIFs that do not invest in Irish real estate – more on which, below – are exempt from Irish tax on income and gains derived from their investment portfolios and are not subject to any Irish tax on their net asset value. Furthermore, QIAIFs do not charge any withholding taxes on payments to investors. Nor is stamp or capital duty payable in Ireland on the issue, transfer, repurchase, redemption of units/shares in a QIAIF.

Taxation of QIAIFs that hold Irish real estate

Ireland introduced a new tax regime for Irish real estate funds under the Finance Act 2016. Under that regime, QIAIFs continue to be exempt from corporation or income tax on their profits. However, 20% withholding tax applies to distributions made by QIAIFs to their investors.

The 20% withholding tax on distributions, redemptions and other payments is imposed on the amount of the payment that is derived from the profits of the QIAIF arising from Irish real estate assets – such as, rental income, gains on disposal and development profits. It may be possible for foreign investors to claim a reduction or exemption from the withholding tax under Ireland’s double tax treaties.

Despite the withholding tax on distributions made to foreign investors, the QIAIF is still exempt from tax at fund level and remains a popular vehicle for large scale projects in excess of approximately €40 million.

Withholding taxes – for QIAIFs that do not hold Irish real estate

No Irish withholding taxes apply to the payment of dividends or distributions to investors who are not resident in Ireland and have provided the QIAIF with the appropriate tax residence declaration. The payment of redemption proceeds, returns of capital or payments in relation to the encashment, cancellation or transfer of units to non-Irish resident investors are also exempt from Irish withholding taxes.

Stamp duty and subscription taxes

No stamp duty is payable in Ireland on the issue, transfer, repurchase or redemption of shares in a QIAIF. No subscription taxes are levied by the Irish tax authorities on the assets of a QIAIF.

Treaty access

Ireland has an extensive network of double taxation treaties and the Irish tax authorities consider that QIAIFs – other than those established as ILPs or CCFs – are generally entitled to the benefit of Ireland’s extensive tax treaty network.

The availability of treaty benefits can enable a QIAIF to avail of reduced rates of foreign withholding tax that would otherwise apply to the holding of foreign assets. Tax treaty access can be restricted depending on the provisions of relevant tax treaty and the approach of the tax authorities in the treaty country where the QIAIF’s investments are located. Treaty benefits have been obtained from a number of Ireland’s treaty partners, and each jurisdiction should be reviewed on a case-by-case basis.

Election for US tax purposes

A QIAIF that is established as an ICAV can elect to “check-the-box”, which under US tax regulation operates to classify the ICAV as a partnership or a disregarded entity for US federal tax purposes. This feature can enhance the attractiveness of the ICAV for US taxable investors, who generally prefer to invest in tax transparent vehicles. An ICAV is subject to the same domestic tax treatment as other corporate funds, i.e. there is no Irish tax on its income or gains and no Irish withholding taxes or stamp duty applies.

VAT

The provision of certain standard services to a QIAIF, such as investment management, administration, transfer agency and depositary services, are treated as VAT exempt in Ireland. Other services, such as legal and accounting services, can result in a liability to Irish VAT. QIAIFs can, however, recover such VAT charges based on the VAT recovery rate, which is calculated based on the proportion of the QIAIF’s investments that are located outside the EU or, alternatively, based on the portion of investors that are located outside the EU.

QIAIF authorisation process and timeframe

Authorisation process

QIAIFs are subject to a 24-hour authorisation process by the Central Bank, which means that if an application - including the relevant certifications by the AIFM and depositary – to authorise a QIAIF is submitted to the Central Bank by 5pm on a business day, the QIAIF will be authorised by the Central Bank on the following business day.

QIAIFs that propose to invest in Irish real estate or digital assets are required to file a pre-submission with the Central Bank. If a pre-submission with the Central Bank is required, the submission should be made during the period of review and drafting of the fund documents and therefore should not delay the timeframe for the authorisation of the QIAIF.

Authorisation timeframe

A realistic timeframe for the authorisation of the QIAIF should be in the region of 10 to 12 weeks, from the time legal advisers are instructed to draft the QIAIF’s prospectus. During this period, service providers will need to be selected, and the prospectus, material contracts and other fund documents will need to be drafted, negotiated and agreed with the AIFM, administrator and depositary.